-

Step Up to Serve Heritage Church

This spring brings many opportunities for you to step into leadership and serve Heritage Church and our wider denomination. Here are just a few:

Have you considered serving on our HUUC Board of Trustees or on our Endowment Committee? Nominate yourself or someone else by contacting Board Vice-President Julie Kane, at :

There are three three-year Board terms open beginning in July. There is one three-year term for the Endowment Committee beginning in July.

Would you like to get involved in Unitarian Universalism in the Greater Cincinnati area? Consider stepping up to represent Heritage on the UU Council of Greater Cincinnati. Again, apply to Julie Kane (see email address above).

All candidates will be voted on at our Annual Meeting on June 2, 2024.

Interested in being a delegate from Heritage to this year’s online-only UUA General Assembly? Speak with Board President Jaime Castle at:

You may have heard that there are important matters being voted on during G.A. this June. Heritage is entitled to four lay delegates, each of whom has a vote in those matters. We’d love to have our full slate of delegates filled this year, so if you’ve been thinking about this kind of involvement, now is the time to toss your hat in the ring. You don’t even have to leave the comfort of your own home, or your own laptop! If you have questions about General Assembly, speak with Rev. Bill Gupton at:

Image Source: https://tinyurl.com/sye7fk53

-

How to Make Your Kroger Plus Card Help HUUC

Kroger Community Rewards is an easy way you can help support HUUC with no cost and almost no effort. Through this program, every time you scan your Kroger shopper’s card and make a purchase, Kroger will donate a small amount to HUUC at no additional cost to you. Here’s how you can help:

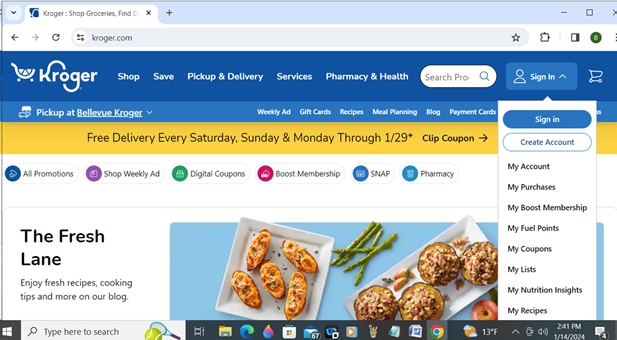

Go to www.kroger.com and click on the “Sign In” button in the top-right corner to open the dropdown menu.

*

* - Already have an account? Click “Sign In” from the dropdown menu and enter your email and password to log in.

- If you don’t remember your password, you can click the “Forgot Password?” link right below the password input field and follow the instructions.

- Don’t have an account yet? Click “Create Account” from the dropdown menu and follow the instructions to create your account. Be sure to have your Kroger card handy so that you can enter the number to link your card to your account.

- Don’t have a Kroger card? Ask for one during your next Kroger visit.

After you are logged in, click the “My Account” link, located in the same “Sign In” dropdown menu you clicked at the beginning.

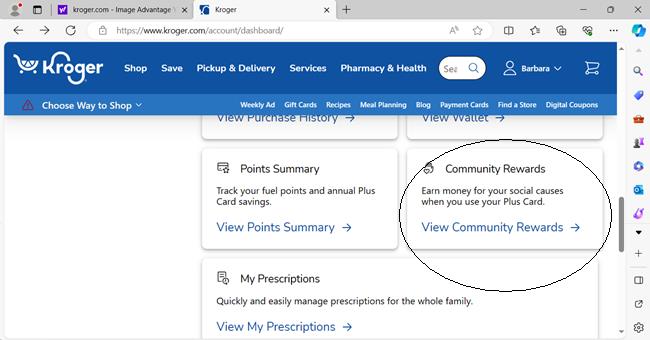

On the My Account page, scroll down and click the Community Rewards link from the menu on the left-hand side of the page.

Click the blue “Enroll” button

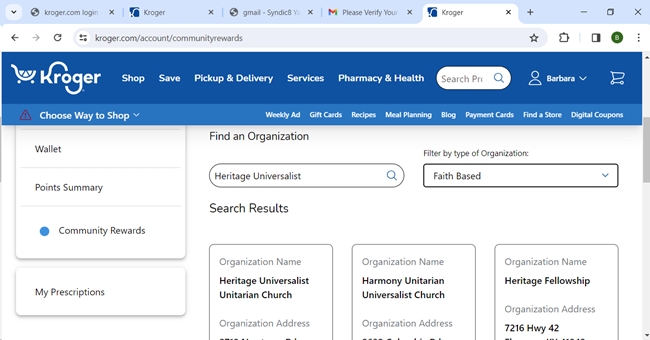

In the search bar under “Find an Organization”, type in “heritage universalist”, then hit enter. You can also search by or organization number, GM909.

You should see a list of organizations pop up and HUUC will be the first one on the list. It is listed as:

Heritage Universalist Unitarian Church

Organization Address

2710 Newtown Rd

Cincinnati, OH 5244Click the blue “Enroll” button underneath Heritage. You should now see your status as “enrolled,” and you can confirm that HUUC is listed as the organization name.

You’re done! Please be sure to scan your Kroger card whenever you shop – if you don’t scan your card, your purchases won’t count for the Community Rewards program.

This whole process also can be done through the Kroger app on your smart phone, though the exact directions may differ a bit.

If you have any questions about Kroger Community Rewards or need help, please ask Luke Walczewski at the address below:

I’m happy to assist.

Additional directions, as passed out at the HUUC January 14 worship service are available at the online leaflet at this link: HUUC Kroger Community Rewards Instructions

- Already have an account? Click “Sign In” from the dropdown menu and enter your email and password to log in.

-

Save Taxes and Support Heritage

by Rebecca A. Pace, CPA/PFS, HUUC Accounts Receivable Treasurer

I want to be sure you are aware of a tax savings strategy that many members of Heritage are using to support our church: Qualified Charitable Distributions or QCDs.

If you are over 70 ½ you can have a distribution from your IRA sent directly to the church, and not pay any tax on the withdrawal. If you are already taking withdrawals from your IRA and making charitable contributions out of your pocket, this method will reduce your Adjusted Gross Income, and your income tax. It may reduce the taxable portion of your Social Security. It also reduces the income that is taxable to the State of Ohio. A simple charitable deduction cannot do all of these things.

If you are over 72, these distributions count towards your Required Minimum Distribution (RMD).

You will get a tax statement from the church, acknowledging your gift. In most cases the statement will indicate if the donation came from your IRA, but it is your responsibility to verify the exclusion limitations and determine if the contribution qualifies as a QCD.

Remember, IRA means “Individual.” The distribution comes from an Individual’s account, not a joint account, so the income exclusion is for the Individual.

QCDs can be made from inherited IRAs. A QCD can come from a Roth IRA, but it would not give you any tax benefit.

There are a few rules to follow. The distribution must be made directly by the trustee of your IRA to the church or other qualifying charitable organization. Not all charities qualify. The maximum that can qualify for a QCD can be more than your RMD, but cannot exceed $100,000 per person. If you contribute to your IRA in the same year you make the distribution, the full amount of the distribution may not be excluded from income. Also, if your IRA includes non-deductible contributions, only a portion of the distribution qualifies for income exclusion.

A QCD is reported, by the custodian, on the annual 1099-R tax statement, like any other IRA withdrawal. The full distribution is reported on your tax return, along with the offsetting exclusion. You can still report the income and take a deduction for a charitable contribution, but using the QCD strategy will probably give you a more generous tax benefit.

Be sure to consult your tax advisor for advice about your specific situation.

Your support of Heritage can be a win all around, for the church and for your pocketbook.

March, 2022.

-

Leveraging the Benefit of Your Gifts, Part Three

by Rebecca Pace, HUUC Accounts Receivable Treasurer

If you have stock that has been held for more than one year, you can donate the appreciated stock to the church, deduct the fair market value of the stock as a charitable deduction, and pay no tax on the unrealized gain.

Selling the stock yourself and taking a deduction for the cash gift may actually result in higher taxes. First, because of the increased standard deduction, an itemized deduction has lost some value. Also, the taxable gain on the stock will increase your Adjusted Gross Income which will increase your Ohio taxable income. If you are receiving Social Security, the additional income may increase the tax burden on your benefits.

If you are considering doing this, talk to us first. The church has a brokerage account that will allow a quick and painless transfer. If you talk with your financial advisor first, they will probably want to open a new account that will double the paperwork and delay the transfer.

If the stock has a loss, you may want to sell it first, donate the proceeds to the church, for an itemized deduction, and deduct the loss on your tax return.

November, 2019.

-

Leveraging the Benefit of Your Gifts, Part Two

by Rebecca Pace, HUUC Accounts Receivable Treasurer

Since the change in the tax law, increasing the standard deduction, Donor Advised Funds (DAF) have become more popular. Think of them as charitable savings accounts.

Tax-deductible contributions to a DAF allow a taxpayer to bunch their charitable contributions into one year, in order to itemize deductions, while taking the standard deduction in other years. You get the tax deduction when you make the contribution to the fund, but the actual grant to the church or other charity can be made later. This is particularly effective if you have unusually high income one year, with extra cash, but you want to be able to make contributions in later years when your cash flow is back to normal levels.

Donor Advised Funds have been around since 1931. The Greater Cincinnati Foundation sponsors DAFs as well as many brokerage houses. If you are considering this strategy, shop around to find one that fits your needs. Costs and support vary.

Your donation to the DAF is irrevocable. Technically, the donor advises the DAF custodian on when and what organizations should receive grants. There are a few restrictions on what type of organizations can receive grants from a DAF. You can make grants to the church or Heritage Acres or to the Endowment Fund.

Donor advised funds can accept cash, or stock or other property that can be sold. Most DAFs have a limited menu of investment choices you may use until you make the actual grant to the church or other charity.

October, 2019.