-

IPM’s Most Needed Items

Bob Drake, our contact with IPM (Inter Parish Ministries), is making a special request to Heritage folks for donations of personal care items. These items are constantly in demand (and often in short supply) – especially feminine care products, such as menstrual pads and tampons.

Bob asks members of the HUUC community to bring sanitary pads and tampons to the church and place them in the IPM designated shopping cart located in the Great Hall. You will be providing a valuable service to IPM and our neighbors who count on IPM (and you too!).

Image source: https://tinyurl.com/5yxx9xm3

-

Remember the 13th Month!

Dear HUUC Members and Friends,

We are very near the end of the 2024 calendar year, which means that we are also close to launching our first-ever 13th month pledge campaign. The idea with this supplemental pledge campaign is that we will ask each pledging member and friend to contribute the equivalent of one month’s pledge as an additional “13th month” donation to the church.

Here’s how this campaign will work. Just after Thanksgiving, all members and friends who made a pledge for the current fiscal year will receive an email from me via huucpledge@gmail.com. In that email, I will let you know what your 13th month pledge would be based on your current yearly pledge amount. You will have the option of paying your 13th month pledge as an additional full month’s payment, or you will be able to choose a different amount.

If you currently make your pledge payments via EFT, then you will be able to select that payment option for the 13th month pledge (I’ll include a submission deadline in order for the EFT withdrawal to happen by the end of the year). You will also have the option of paying via check.

This fund-raising concept received very strong support at our last Annual Meeting, and I’m looking forward to seeing how generous we can be with this effort over the holiday season. The 13th month pledge campaign will run from the week after Thanksgiving through the end of the year.

Please email me if you have any questions at:

Yours in service and generosity,

Reid Hester

HUUC Stewardship Chair

Image source: https://bit.ly/3NoGtax and https://bit.ly/3BJU2is

-

Ushering — It is Worship Service “Double Dipping”

If you already plan to attend a Sunday worship service in person, why not simultaneously help with the easy task of ushering. Ushering requires little additional time and effort on your part while helping the Heritage community. Consider it worship service “double dipping.” You personally benefit from the worship service while at the same time benefit the community.

You say you have concerns.

Concern: I can’t commit to a series of Sundays.

Answer: No Problem! You can sign up for single Sunday stints.Concern: I don’t have someone to “partner” with me.

Answer: No Problem! We will match you up with someone.Concern: I like to sit with my spouse/friend during the service.

Answer: You both can usher for the service and sit together by the door to the sanctuary.Concern: I don’t know what to do and don’t have time for extensive training.

Answer: No Problem! We can “show you the ropes” in a minute – literally!Concern: I’m not very outgoing.

Answer: No Problem! Just be your friendly self – smile, say “Good Morning” as attendees enter the sanctuary and hand them a bulletin.Concern: I don’t have any other excuses.

Answer: Great! So now just sign up for dates that works for you on SignUpGenius.com at https://tinyurl.com/4mxpcf4h and come to church about 30 minutes before the service begins. If you have any additional questions, contact Bob Drake at drake.bob@gmail.com.If you contact Bob, he will also send you the link to the SignUpGenius so that you are put into the ushering pool – allowing you to pick and choose when you want to usher and even delete previous sign ups if something comes up (e.g., illness or new obligation.) Bob will even make those changes for you if you email him.

So, come help-out! You’ll enjoy this easy experience of giving to Heritage.

Image source: https://tinyurl.com/244vru3u

-

Inter Parish Ministries Food Pantry Requests

Specific Items Needs

Even though the end of the school year and most graduation parties are recent memories, not many of us are thinking of the start of another school year, yet. However, Inter Parish Ministries (IPM) is already gearing up for their annual Back To School (BTS) Drive.

The staff at IPM has reached out to Heritage to ask if we would donate the following items for the BTS initiative that provides school supplies for hundreds of students.

- Dry Erase Markers

- Pens

- Glue Sticks

All donations can be placed in the grocery cart in the HUUC Great Hall no later than Sunday, August 4, 2024. All of the supplies will be included in backpacks distributed to families before the opening of school.

If you have questions, please contact Ann Roberts at 419-350-9064

IPM Volunteers Needed

Volunteers serving on a regular schedule are also needed at IPM. Now that the new pantry is open, they are providing more services that require more volunteers. Along with the drive thru pick-ups four days a week, Choice Shopping is now available three afternoons a week. IPM is in need of volunteers in the afternoons with jobs such as front desk receptionist, shelf stockers, greeters, and shopper’s companions. If you would like to volunteer, contact Marsha Blair at

or call 513-527-6274. The new pantry is now located at 4623 Aicholtz Rd in Union Township.

Image source: https://www.ipmfoodpantry.org/about

-

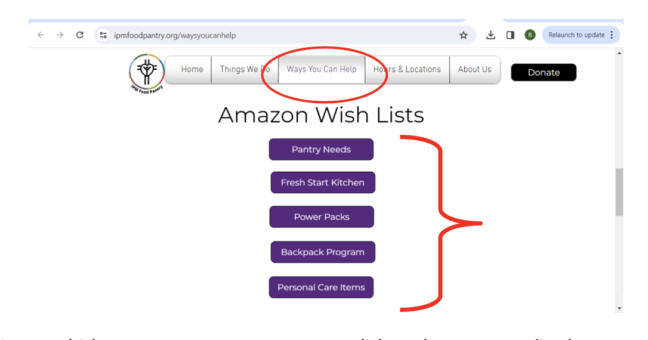

Efficient Inter Parish Ministry (IPM) Giving

You want to give needed items to IPM (Inter Parish Ministry) but …

1) You’re unsure of what IPM needs.

2) You just went to the store & forgot.

3) You bought something and you planned to bring it to church to put in the donations shopping cart in the great hall but you’re going to be out of town, or you’re zooming to HUUC, or you just plain spaced out.Here’s a solution – it’s quick, easy, and you can do it from home.

Go to:

- https://www.ipmfoodpantry.org/

- Click on the big “Ways you can help” button in the top menu ribbon. (If you are using a mobile device, click on the two parallel, horizontal lines at the upper right-hand corner to access the “Ways you can help” button.)

- Scroll down to the Amazon Wish Lists (there are five: Pantry Needs, Fresh Start Kitchen, Power Packs, Backpack Program, Personal Care Items)

Depending on which program you want to support, click on the corresponding button and it will take you to the Amazon wish list, with suggested items matching the needs of that program. The items you select will be added it to your cart and, upon payment, just select the address for IPM (it will appear as one of your address options)

That’s it, you’re finished! You’ve helped those in need and didn’t even have to get up off the couch! More importantly, the items selected are things IPM needs that match the needs of the neighbors IPM serves.

Image source: https://tinyurl.com/59vt4dsr and IPM logo